San Diego County Housing Report: Not About the Price

December 27, 2021 - Call George Lorimer and Start Packing 619-846-1244

Steven Thomas - Quantitative Economics and Decision Sciences

Click here for a full report with home prices, inventory, and graphs.

Everyone is acutely aware that home prices have been soaring for the past year and a half. They have far exceeded the runup in values before the Great Recession. As a result, many people are on edge, wondering how values can continue to rise beyond their current record highs. But, in focusing just on prices, it is no wonder they fear an end to the pandemic housing run.

Analyzing today’s housing market is not just about home prices. Household incomes and mortgage rates over time tell a completely different story. For example, in 1980, the median detached home price in San Diego County was $94,391. That sounds incredibly cheap and an unbelievable deal; however, mortgage rates averaged 13.75%, and the median household income was only $18,000. As a result, the monthly mortgage payment was a more significant proportion of a new homeowner’s monthly income than today.

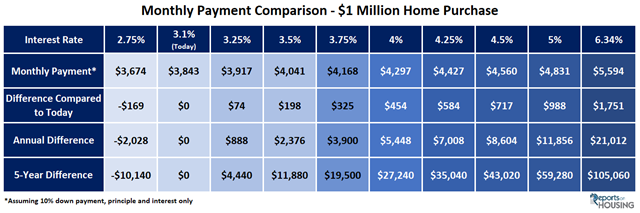

Similarly, in 2007, before the Great Recession, the median detached home price in San Diego County climbed to $589,000, a lot lower than today’s $850,000 level as reported by the California Association of REALTORS® for October. Yet, mortgage rates averaged 6.34%, and the median household income was $62,000. The monthly mortgage payment was an even more significant proportion of a new homeowner’s monthly income than today, significantly more significant.

According to Freddie Mac’s Primary Mortgage Market Survey®, a 30-year fixed-rate mortgage is 3.1%. Yes, rates were lower earlier this year, but in comparing today to any time before the start of the pandemic in March 2020, today’s rate would be a record low. The lowest rate before COVID occurred in November 2012 at 3.31%. In addition, household incomes have been methodically rising over time, likely surpassing $90,000 in San Diego County this year. The current low-rate environment, coupled with higher incomes, continues to entice a flood of buyers to pursue the purchase of a home.

In analyzing the housing market and where it stands today, home prices are a critical component, yet household incomes and mortgage rates are equally important factors. As household incomes rise, families’ monthly paychecks rise. As interest rates drop, home buyers are looking at smaller monthly payments. Download the full report here.