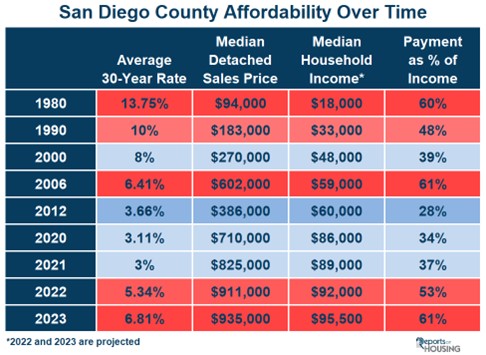

The answer is people buying a median-priced home with a median income, they spend 61% of their income for a home. This means that if you make a $10,000 monthly income (gross, before taxes), your payment would be $6100/mo.

Is this unprecedented? No, it has hovered before at that number, but it is tied to the highest we've seen.

The payment is a function of the house cost and the mortgage rates. The median San Diego home price is $867,000. Download the complete report.

San Diego County Housing Report: Affordability Predicament July 11, 2023

Even though the housing market is hot once again, many buyers have been pushed to the sidelines due to the high mortgage rate environment.

Find Out What Your Home Is Worth

This year’s housing market is booming despite the higher mortgage rate environment. Open houses are lined with buyers. Bidding wars have returned, along with homes selling above their asking prices. Housing is crazy once again. To many, it seems as if more buyers are looking to purchase today than before the pandemic, or very similar to the COVID years of the second half of 2020 through the first several months of 2022. Yet, the actual number of buyers in the marketplace is far fewer than many realize. How can that be?

It is as if Disneyland decided to limit attendance to 50% of its average summer ticket sales. Park attendees would expect to walk on just about every ride. But once they enter the “Happiest Place on Earth,” they quickly find that only half the attractions are open, and the lines are just as long as a typical summer day. That is precisely what is going on in the housing market today. With rates at nearly 7% and affordability at tragically low levels, buyers would expect to take their time as homes for sale sit, and sellers anxiously wait for any purchase offer to come in. However, there is a catastrophically low number of homes available, resulting in buyers competing to purchase.

Today’s San Diego County housing market is characterized by a lack of affordability, low demand, a limited number of homeowners willing to sell their homes, and an extremely anemic inventory. To understand why buyer demand is weak, it is essential to consider where interest rates, incomes, and home prices have been over time and their impact on affordability. Interest rates have been higher than they currently stand today, but that does not mean it was more unaffordable. In 1980, the average mortgage rate was 13.75%, the median income was $18,000, and the median detached sales price was $94,000. That meant the monthly housing payment was 60% of the median household income. Rates continued to drop, and incomes climbed decade after decade. In 2000, mortgage rates were at 8%, the median income more than doubled in 20 years, rising to $48,000, and the median detached sale price climbed to $270,000. Yet,

Click here to download a free copy of the 12-page report.

Is this unprecedented? No, it has hovered before at that number, but it is tied to the highest we've seen.

The payment is a function of the house cost and the mortgage rates. The median San Diego home price is $867,000. Download the complete report.

San Diego County Housing Report: Affordability Predicament July 11, 2023

Even though the housing market is hot once again, many buyers have been pushed to the sidelines due to the high mortgage rate environment.

Find Out What Your Home Is Worth

Demand is Low Due to Affordability - Today’s monthly payment is 61% of the median household’s monthly income at the current rate and median detached sales price.

This year’s housing market is booming despite the higher mortgage rate environment. Open houses are lined with buyers. Bidding wars have returned, along with homes selling above their asking prices. Housing is crazy once again. To many, it seems as if more buyers are looking to purchase today than before the pandemic, or very similar to the COVID years of the second half of 2020 through the first several months of 2022. Yet, the actual number of buyers in the marketplace is far fewer than many realize. How can that be?

It is as if Disneyland decided to limit attendance to 50% of its average summer ticket sales. Park attendees would expect to walk on just about every ride. But once they enter the “Happiest Place on Earth,” they quickly find that only half the attractions are open, and the lines are just as long as a typical summer day. That is precisely what is going on in the housing market today. With rates at nearly 7% and affordability at tragically low levels, buyers would expect to take their time as homes for sale sit, and sellers anxiously wait for any purchase offer to come in. However, there is a catastrophically low number of homes available, resulting in buyers competing to purchase.

Today’s San Diego County housing market is characterized by a lack of affordability, low demand, a limited number of homeowners willing to sell their homes, and an extremely anemic inventory. To understand why buyer demand is weak, it is essential to consider where interest rates, incomes, and home prices have been over time and their impact on affordability. Interest rates have been higher than they currently stand today, but that does not mean it was more unaffordable. In 1980, the average mortgage rate was 13.75%, the median income was $18,000, and the median detached sales price was $94,000. That meant the monthly housing payment was 60% of the median household income. Rates continued to drop, and incomes climbed decade after decade. In 2000, mortgage rates were at 8%, the median income more than doubled in 20 years, rising to $48,000, and the median detached sale price climbed to $270,000. Yet,

Click here to download a free copy of the 12-page report.

Categories:

San Diego Market Statistics

We would like to hear from you! If you have any questions, please do not hesitate to contact us. We are always looking forward to hearing from you! We will do our best to reply to you within 24 hours !